The Crossroads of Packaging Reform

The Australian government’s push for stricter packaging regulations has been underway for many years. However, the most recent announcement regarding impending proposed packaging reforms has sent shockwaves through the fresh produce industry. The recent consultation outcomes from the Department of Climate Change, Energy, the Environment and Water (DCCEEW) revealed an overwhelming shift towards a federally managed Extended Producer Responsibility (EPR) scheme, including phased or even outright bans and enforced levies on certain packaging materials such as plastic packaging and specifically soft plastics.

For fresh produce businesses, this could represent a seismic shift — one that could drastically alter supply chains, operational costs, and even food waste outcomes.

For those not aware of the packaging reform discussions or the government intervention that has taken place since the APCO 2025 targets were not met, this article explores the history of APCO’s regulatory framework, our position in the recent consultation, and the implications of the DCCEEW findings for fresh produce growers and suppliers.

The Evolution of Packaging Regulation in Australia

APCO’s Origins and Initial Objectives

The Australian Packaging Covenant Organisation (APCO) was established as a voluntary, industry-led initiative to guide businesses towards sustainable packaging solutions. APCO has been steering Australia’s efforts toward the 2025 National Packaging Targets. These ambitious goals aimed to revolutionise the nation’s approach to packaging sustainability.

Operating under a co-regulatory model, APCO worked in partnership with businesses, government, and environmental groups to improve packaging sustainability through a combination of target setting, reporting frameworks, and voluntary compliance measures. Naturpac were strong supporters of the 2025 goals and strategy, and many of our sustainable packaging products were specifically sourced and developed to align with these goals.

But the question stands – did APCO succeed in their strategy? And if they didn’t (spoiler alert: they’ didn’t) what were the driving factors that slowed or hindered success?

A birds eye view of APCO’s 2025 progress:

- 2018: Targets were introduced, aiming for 100% recyclable, reusable, or compostable packaging by 2025

- 2019-2021: Reports show slow progress, especially in achieving recycled content thresholds

- 2022: Businesses failed to meet voluntary benchmarks, leading to calls for stricter regulations

- 2023: APCO performed interim review, major concerns targets cannot be met

- 2024: DCCEEW announces intention to intervene federally, significant changes proposed

- 2025: Targets not met, impending reforms consultation with industry and public underway

APCO’s 2025 Progress

2018-2020: Establishing the Baseline

Total Packaging Placed on Market (POM): Approximately 5.9 million tonnes.

Overall Recycling Rate: 56%, with materials like paper and cardboard achieving higher recovery rates compared to plastics.

These figures showed the necessity for targeted strategies, especially concerning plastic packaging, which had much lower recycling rates.

A significant development in 2020 was the revision of the recycled content target. In March of 2020, APCO increased the goal from 30% to 50% average recycled content across all packaging, reflecting a commitment to enhancing the use of recycled materials.

Despite being so early into the strategy – APCO was aware the targets would not be met by 2025 – and called for further support managing business owners to ‘do their part’. They ramped up their investment and collaboration with 23 project committments for the 2020–2021 financial year. These projects addressed reuse models, recycling improvements, composting initiatives, increased uptake of recycled content, and the elimination of single-use plastics. They involved stakeholders from across the packaging supply chain, to try and equip Australia’s industries with the necessary tools and knowledge to meet the 2025 targets.

2021: Early Signs of Progress

Building upon the baseline, the subsequent report highlighted modest improvements:

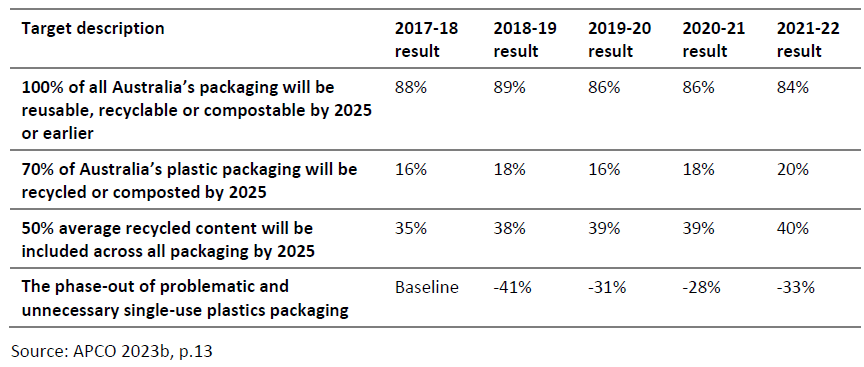

Recyclable Packaging: An increase from 88% to 89% in packaging classified as recyclable.

Plastic Packaging Recycling Rate: A slight increase from 16% to 18%.

APCO released the “Collective Impact” report in November 2021, which assessed Australia’s progress towards these targets and explored alternative interventions to support the transition to sustainable packaging practices. With minimal gains, the data emphasised the need for accelerated efforts, particularly in enhancing plastic recycling infrastructure and consumer participation.

2022: Mid-Term Reflections and Strategic Reassessment

By 2022, APCO undertook another review to evaluate the nation’s trajectory towards the 2025 targets. The findings were mixed:

Reusable, Recyclable, or Compostable Packaging: Maintained at 89%.

Plastic Packaging Recycling Rate: Stagnant at 18%, highlighting ongoing challenges in this sector.

Recycled Content in Packaging: Stood at 44%, approaching the 50% target.

Phase Out Single-Use Plastics: Achieved a 40% reduction from the baseline.

During this period, the only major soft plastics recycling program in Australia – RedCycle – collapsed. Shock waves rippled throughout many industries, with the most significant impact on major grocery chains Coles, Woolworths and ALDI.

2023: Incremental Progress Amidst Persistent Challenges

By 2023, APCO had undertaken a comprehensive review to evaluate the nation’s trajectory toward the 2025 targets. The “Review of the 2025 National Packaging Targets,” released in April 2023, served as a pivotal document in this assessment. Key insights from this review included:

Target 1: 100% Reusable, Recyclable, or Compostable Packaging

Progress: Approximately 86% of packaging was classified under this category.

Challenges: The remaining 14% posed significant hurdles due to material complexities and the lack of viable end-of-life processing options.

Target 2: 70% Recycling or Composting Rate for Plastic Packaging

Progress: The recycling rate for plastic packaging lingered at a modest 18%.

Challenges: Insufficient recycling infrastructure and low consumer participation rates were primary obstacles.

Target 3: 50% Average Recycled Content in Packaging

Progress: The average recycled content in packaging reached 44%.

Challenges: Supply chain limitations and quality control issues hindered further advancement.

Target 4: Phasing Out Single-Use Plastics

Progress: A 40% reduction from the baseline was achieved.

Challenges: Certain single-use plastics remained prevalent due to their indispensable roles in specific applications.

In light of these findings, APCO once again pushed for a stronger co-regulatory framework, placing importance on enhanced collaboration between industry stakeholders and government entities to bridge existing gaps.

The report highlighted that while certain materials like paper and glass showed good recovery rates, plastics continued to lag, necessitating focused interventions.

2024: Recognising the Need for Accelerated Action

As the 2025 deadline approached, it became evident that achieving the set targets required intensified efforts:

Reusable, Recyclable, or Compostable Packaging: Slight decline to 84%, attributed to reclassification of certain flexible plastics due to changes in recycling capabilities.

Plastic Packaging Recycling Rate: Persisted at 18%, underscoring systemic challenges.

Average Recycled Content: Held steady at 44%.

Phase-Out Single-Use Plastics: Achieved a 40% reduction, yet complete phase-out remained elusive.

APCO’s review underscored the imperative for a cohesive, system-wide approach, integrating efforts from all stakeholders to surmount existing obstacles.

2025: Reflecting on the Journey and Charting the Path Forward

As the 2025 deadline arrived, it became evident that while progress had been made, the original targets would not be fully realised within the anticipated timeframe. APCO again acknowledged this reality, emphasising the importance of sustained efforts and the recalibration of strategies to adapt to evolving challenges.

As of February 2025:

Reusable, Recyclable, or Compostable Packaging: Approximately 85%.

Plastic Packaging Recycling Rate: Marginal improvement to 19%, still significantly below the 70% target.

Average Recycled Content: Reached 45%, nearing the goal but necessitating further enhancement.

Phase-Out of Problematic Single-Use Plastics: Maintained a 40% reduction.

Where The Plan Fell Short

While APCO played a critical role in setting industry wide sustainability goals, its effectiveness was frequently questioned. Key concerns included:

Lack of Regulatory Enforcement

APCO operates under a co-regulatory model, relying heavily on voluntary compliance from businesses. This structure lacks the stringent enforcement mechanisms necessary to ensure uniform adherence across the industry. APCO’s CEO, Chris Foley, highlighted this concern, stating, “It is time for many businesses to do more to reduce the impact of their packaging and improve its recoverability.”

Inconsistent Government Policies

Variations in packaging regulations across different jurisdictions have created complexities for businesses striving to implement standardised sustainable practices. The absence of a cohesive national strategy has hindered streamlined progress.

Insufficient Infrastructure

The current recycling and composting infrastructure in Australia is inadequate to process the volume and diversity of packaging waste generated. This limitation has been a significant barrier to increasing recycling rates, particularly for plastic materials.

Slow adoption of recyclable materials

Many businesses continued using non-recyclable packaging due to cost constraints or supply limitations.

Competitive Disadvantages for Early Adopters

Companies proactively investing in sustainable packaging solutions often face higher operational costs. Without widespread industry participation, these early adopters are at a competitive disadvantage, discouraging broader commitment to the targets.

Retailer-driven decisions

Growers and suppliers were largely at the mercy of retailer packaging specifications, limiting their ability to transition independently.

As frustration grew with APCO’s progress, the government launched a review of packaging regulations, culminating in the recent consultation process that would determine the future direction of packaging policy in Australia.

APCO CEO Chris Foley’s sentiments seemed largely disappointed that industry didn’t take its role seriously and in many cases, just didn’t pay any attention at all. “The task at hand is much bigger than any one business. Collaboration and cooperation across the packaging industry, government, waste, and recycling sectors is needed to drive change.”

APCO’s 2030 Vision

In August 2024, APCO unveiled its 2030 Strategic Plan, aiming to double down on efforts to improve Australia’s packaging landscape by addressing previous challenges and setting a clear path toward achieving the National Packaging Targets.

Key Components of the APCO 2030 Strategic Plan

Eco-Modulated Fee Structure

Implementation Timeline: Proposed to commence in the financial year 2026-27 (FY27).

Fee Determination: Fees will be based on the types and volumes of packaging that members introduce to the market. Materials that are more challenging or costly to recycle will incur higher fees.

Objective: This structure incentivises businesses to reduce packaging, adopt reusable models, and transition to materials that are easier to recycle, promoting sustainable packaging design.

Direct Investment in Recycling Infrastructure

Fund Allocation: Revenue generated from the new fee model will be reinvested into the recycling system.

Focus Areas: Enhancing collection networks, developing reprocessing facilities, and supporting end markets for recycled materials.

Goal: To overcome existing economic barriers and boost Australia’s recycling rates, ensuring the effective processing of diverse packaging materials.

Reduction of Landfill Waste

Target: By 2030, reduce the volume of packaging materials sent to landfill by 1 million tonnes.

Strategy: Implement new indicators to track progress, focusing on waste minimisation and promoting circular economy principles.

Enhancing Social License for Brands

Community Alignment: Ensure that brands meet evolving community expectations regarding sustainable packaging design and disposal.

Supportive Systems: Provide frameworks that allow businesses to align with societal values, thereby maintaining their social license to operate.

The development of this strategic plan involved consultation with over 2,400 industry members, as well as stakeholders from the waste and recycling sectors, industry associations, and government bodies.

Some of those included in the consultations were major organisations such as Unilever. They supported the introduction of EPR and levy based schemes claiming they successfully support the recycling systems needed to account for their footprint.

“At Unilever, we believe EPR schemes where companies pay to support the collection and processing of packaging can help to improve recycling systems. The eco-modulated fee structure being developed by APCO is a significant step towards enhancing packaging material circularity in Australia. This initiative aligns with Unilever’s plastic reduction goals and reinforces our commitment to lead by example for systems change on a global scale.” Brooke Sprott, Head of Sustainable Business and Communications – Unilever ANZ.

From a fresh produce perspective, this sentiment seems largely luxurious. When majority of the producers are operating on paper thin margins, battling environmental issues with serious impacts on crop quality – increasing packaging costs places further cost burden on operations. Add to this new levies attributed to the recycling and waste management of their packaging, its an almost incomprehensible imposition. Especially when you factor that any mid tier grower producing for major retailers has minimal control over their packaging options in the first place. The question begs – was this considered by APCO during their consultation process?

The DCCEEW Intervention

Prior to APCOs current involvement, the National Environment Protection (Used Packaging Materials) Measure 2011 (NEPM) established a co-regulatory framework for packaging in Australia. Under this system, businesses with an annual turnover of $5 million or more were obligated to either become signatories to the Australian Packaging Covenant (the Covenant) and members of APCO or report directly to their respective state or territory government agencies. This framework aimed to reduce the environmental impacts of packaging through industry-led initiatives complemented by government oversight.

However, an independent review conducted in 2021 revealed significant shortcomings in the implementation and enforcement of the NEPM. The review highlighted that while the Covenant functioned effectively as a voluntary stewardship initiative, the broader regulatory arrangements failed to deliver the desired environmental outcomes. In response to these findings, Environment Ministers agreed in October 2022 to reform packaging regulation by 2025, aiming to ensure that all packaging in Australia is designed for recovery, reuse, recycling, and safe reprocessing in alignment with circular economy principles.

This is where DCCEEW was charged to step in and take a more active role.

The DCCEEW Consultation

Key Themes of the Consultation

In September 2024, the Department of Climate Change, Energy, the Environment and Water (DCCEEW) initiated a comprehensive consultation process to reform Australia’s packaging regulations. This initiative aimed to address the environmental impacts of packaging and transition towards a circular economy.

Consultation Process Overview

- Webinars: DCCEEW hosted webinars on 25 and 26 September 2024, engaging over 1,000 stakeholders from various sectors. These sessions provided an overview of the proposed reforms and facilitated discussions on potential regulatory changes.

- Consultation Paper Release: On 27 September 2024, DCCEEW published the “Reform of Packaging Regulation Consultation Paper,” outlining three potential reform options and inviting public feedback.

- Public Feedback: The consultation period, which concluded on 29 October 2024, garnered 426 formal responses. Additionally, a letter supported by 12,400 signatories and campaign-style letters from 8,773 individuals were submitted, reflecting significant public interest and concern.

Proposed Reform Options

The consultation paper detailed three primary options for regulatory reform:

Strengthening Administration of the Co-Regulatory Arrangement

Enhancing the existing co-regulatory framework without substantial structural changes.

- Improved monitoring and enforcement mechanisms.

- Clearer definitions and goals to address inconsistencies.

- Increased accountability to reduce free-rider issues undermining industry-led efforts.

National Mandatory Requirements for Packaging

Implementing uniform packaging standards through Commonwealth legislation.

- Bans on problematic materials and chemicals of concern.

- Progressive bans mandating minimum recyclability performance.

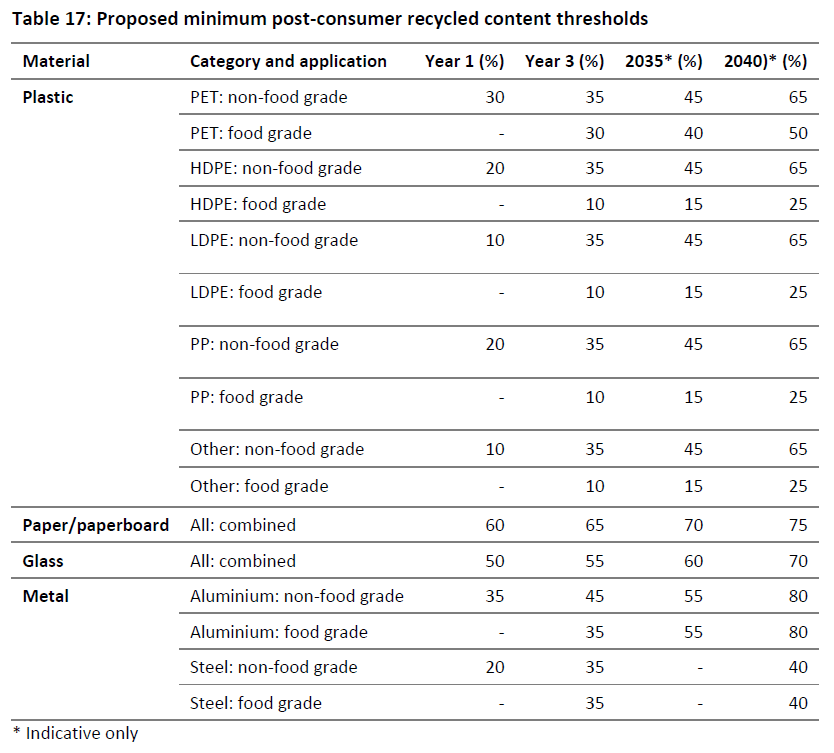

- Minimum recycled content thresholds for packaging materials.

- Cessation of the current co-regulatory arrangement in favor of direct regulation.

National Extended Producer Responsibility (EPR) Scheme

Establishing an EPR scheme with an overseeing administrator to ensure industry compliance.

- Mandated requirements similar to Option 2.

- Eco-modulated fees incentivizing recyclable packaging design.

- EPR fees based on the volume of packaging introduced to the market, supporting both administrative functions and industry initiatives.

Reform Objectives and Principles

The overarching goals of the proposed reforms include:

Environmental Impact Reduction: Minimising packaging waste and its ecological footprint.

Circular Economy Transition: Ensuring packaging is designed for longevity and recyclability.

Regulatory Clarity: Establishing clear, enforceable, and nationally consistent packaging obligations.

These objectives were based on industry responsibility, flexibility to innovate, and alignment with global standards and best practices

Representatives from Naturpac and J-Tech Systems discussed the impacts of these proposed regulations and took an active role during the consultation process. Our consultation submission was detailed, and whilst in principle supported the goals and objectives of the reform and understood the drivers, it was apparent from the questions posed and the manner in which they were posed, that the produce industry was not adequately considered.

Given that in 2019 plastic packaging constituted ~17% of the total packaging placed on the Aussie market (about 1 million tonnes), we’d say the industry deserves fair consideration.

Our Submission, Position and Rationale

Naturpac, representing fresh produce suppliers, advocated for strengthening APCO rather than dismantling it. Our position was rooted in supporting sustainability while ensuring that any regulatory changes were practical, industry-informed, and economically viable for producers, suppliers, and retailers.

Our position was based on:

- Minimising financial pressure on growers

- Sudden regulatory changes could lead to unsustainable cost increases.

- Avoiding regulatory complexity

- A new federal system risked duplicating processes, adding bureaucracy without clear benefits.

- Retailer accountability

- The consultation did not address the role of major retailers in specifying packaging choices for fresh produce categories, placing the burden solely on producers.

Our Position: A Strengthened APCO Model

Naturpac advocated for Option 1—strengthening APCO’s existing co-regulatory model—rather than transitioning to a fully government-controlled system or implementing an EPR scheme with mandatory fees.

Our rationale was based on:

- The need for an industry-led approach: We believe that industry collaboration with government, rather than a government-imposed system, would be more effective in achieving sustainability goals.

- Avoiding undue financial pressure on growers: Many fresh produce businesses operate on thin profit margins, and sudden cost increases could destabilise the industry.

- The risk of overcomplicating the regulatory framework: A Commonwealth-run system or EPR scheme could introduce duplicative processes, inconsistent enforcement, and unnecessary bureaucracy that might not yield proportional environmental benefits.

- Ensuring retailers bear appropriate responsibility: Growers and suppliers have limited control over packaging specifications. Major retailers dictate packaging decisions but have less accountability under the proposed reforms.

Our Submission Recommendations

We outlined several critical recommendations aimed at ensuring that sustainability reforms are fair, effective, and achievable for businesses in the fresh produce sector:

Standardised National Guidelines for Packaging Recyclability

- Current Issue: Inconsistent recycling standards across states and territories create confusion for businesses and consumers.

- Recommendation: Implement a unified, national framework to provide clear packaging design, recyclability, and compliance requirements.

Investment in Recycling Infrastructure

- Current Issue: Many fresh produce packaging materials—particularly soft plastics—lack adequate recycling pathways, leading to unnecessary waste.

- Recommendation: Government should invest in scalable, commercial recycling solutions, particularly for materials essential to food preservation and waste reduction (e.g., modified atmosphere packaging (MAP) and food-grade rPET).

R&D Incentives for Packaging Innovation

- Current Issue: Businesses investing in new packaging technology receive little financial support, despite the high costs associated with material research, machinery upgrades, and production transitions.

- Recommendation: Establish tax incentives or grants for businesses investing in alternative packaging solutions, allowing the industry to lead packaging sustainability through innovation rather than mandatory levies.

Retailer Accountability and Shared Responsibility

- Current Issue: Fresh produce suppliers have little influence over packaging decisions, as major retailers dictate specifications while imposing strict product shelf-life requirements.

- Recommendation: Regulations should place greater responsibility on retailers for sustainable packaging choices—not just suppliers—ensuring cost-sharing mechanisms for packaging transitions.

Clear Transition Periods and Flexibility for Implementation

- Current Issue: An immediate shift to new packaging standards could cause stock write-offs, supply disruptions, and cost spikes.

- Recommendation: Provide longer transition periods (3-5 years) and exemptions for specific packaging types that have no viable alternatives to ensure smooth implementation.

Fresh Produce Packaging Challenges

Unlike other industries, fresh produce packaging has unique functional requirements, including:

Extending Shelf Life & Reducing Food Waste

Packaging solutions such as modified atmosphere packaging (MAP) significantly extend freshness, preventing premature spoilage.

Preventing Damage & Contamination

Cucumbers, berries, and leafy greens require packaging to protect against bruising, moisture loss, and bacterial contamination.

Lack of Commercially Viable Alternatives

Some materials (e.g., polyethylene netting for onions) currently lack functional, recyclable replacements at scale.

Economic Constraints on Growers

Packaging changes cannot be solely absorbed by growers—particularly in a high-cost market with retailer-driven specifications.

Without safeguards, rushed regulations could increase food waste, raise costs for consumers, and reduce packaging effectiveness in preventing product spoilage.

Risks of the EPR Scheme (Option 3)

While the EPR model was presented as a leading solution, we highlighted several major concerns for fresh produce businesses:

Increased Cost Burdens

Mandatory EPR fees could lead to higher retail prices, impacting both producers and consumers.

Lack of Infrastructure to Support New Regulations

If viable recycling facilities for soft plastics, netting, or certain multilayer films don’t exist, producers could be penalised for using materials they have no alternative for.

No Consideration for Food Waste Reduction

Packaging bans or restrictions must account for their impact on food waste, as improperly packaged produce can spoil faster, leading to greater environmental harm.

Limited Influence of Growers & Suppliers

Major retailers control packaging choices, but EPR fees would disproportionately affect suppliers who have no power to dictate packaging materials.

Have we forgotten about food waste?

During our submission, we were faced with a real environmental dilemma. What is more important? If we opt to back hard and fast plastics restrictions and reforms, what are the on flow impacts in other areas?

In Australia, food waste is a significant concern, with fresh produce constituting a substantial portion of the discarded food. Key statistics include:

- Annual Food Waste: Approximately 7.6 million tonnes of food are wasted each year in Australia, equating to about 312 kg per person.

- Fresh Produce Waste: Fresh fruits and vegetables account for about 33% of the total food waste, representing an estimated $2.67 billion in value.

- Household Contribution: Households are responsible for around 30% of Australia’s food waste, amounting to approximately 2.5 million tonnes annually.

- Environmental Footprint: Food waste accounts for about 3% of Australia’s annual greenhouse gas emissions. Additionally, around 2,600 gigalitres of water are used annually to produce food that is ultimately wasted, equivalent to the volume of five Sydney Harbours.

Fresh fruit and vegetable waste in Australia is influenced by a multitude of factors spanning the entire supply chain, from production to consumer behaviour. Key contributors include:

Aesthetic Standards and Market Specifications

A significant portion of produce is discarded due to strict cosmetic standards set by retailers and consumer preferences for visually appealing fruits and vegetables. Estimates suggest that between 20% to 40% of fresh produce is rejected before reaching supermarket shelves because they don’t meet these aesthetic criteria.

Supply Chain Inefficiencies

The journey from farm to retail involves multiple stages where mishandling, inadequate storage, and transportation issues can lead to spoilage. It’s reported that up to 25% of all fruits and vegetables produced never leave the farm, often due to product losses from pests, diseases, weather conditions, or damage during harvesting and handling.

Consumer Behavior

Household practices significantly impact food waste levels. Factors such as over-purchasing, improper storage, and confusion over food labeling contribute to the disposal of edible produce. Surveys indicate that 47% of households discard fresh vegetables and herbs, while 33% dispose of fresh fruit within a typical week.

Environmental Factors

Adverse weather conditions, pest infestations, and diseases can lead to substantial losses in fresh produce. For instance, a berry farm in Adelaide Hills experienced a loss of $250,000 worth of produce due to a fruit fly quarantine, highlighting how environmental challenges can directly result in significant food waste.

Economic Considerations

Market fluctuations and pricing pressures can render the harvesting and distribution of certain crops economically unviable. In such cases, produce may be left unharvested and eventually wasted. Additionally, the cost of labour and transportation can influence decisions to forego harvesting, especially when projected profits are marginal.

What’s Worse?

Balancing environmental priorities is a consideration for the fresh produce sector as in Australia, both plastic packaging and food waste pose significant environmental challenges, but their impacts differ in nature and scale.

While plastic packaging contributes to long-term environmental pollution and resource depletion, food waste has a more immediate and substantial impact on greenhouse gas emissions and resource wastage. Notably, appropriate packaging can play a crucial role in reducing food waste by preserving freshness and extending shelf life.

Annual Food Waste: Approximately 7.6 million tonnes of food are wasted each year in Australia, equating to about 312 kg per person.

Waste Generation: Australia produces approximately 2.5 million tonnes of plastic waste annually, with about 84% ending up in landfill. Comparatively resulting in 2.1 million tonnes of waste not being recycled or composted.

In a utopian world, there would be unlimited funds and resources dedicated to solving these critical issues. But in our current landscape, which do we prioritise? Within Australia, there aren’t many willing to have an opinion on the matter. But when we look further abroad to see what is happening around the world:

Scotland

An article by Zero Waste Scotland emphasises that while single-use plastics are widely recognised for their environmental harm, food waste can have an even more significant impact on climate change. Their analysis reveals that the climate impact of food waste discarded from Scottish homes can be more than twice that of plastic waste.

India

Waste360 discusses the dual-edged nature of plastic reduction efforts. While reducing plastic use is crucial, the article points out that plastic packaging plays a vital role in preserving food quality and extending shelf life. Without adequate packaging, more food would spoil due to exposure to light, physical damage during transportation, and temperature fluctuations, potentially leading to increased food waste.

United Nations

The Food Packaging Forum highlights research from the United Nations Environment Program (UNEP), which analyzed 33 life cycle assessments comparing packaging and food waste. The findings suggest that the environmental costs of food waste outweigh those of packaging waste.

Case Study: Impact of Packaging on Cucumber Shelf Life

We modelled out data based on cucumbers and cucumber packaging. This packaging is currently not able to be recycled through a national soft packaging program, and there are no mass produced compostable options. Additionally there are no current options in market with recycled materials that meet the thresholds for recycled content. Under the reforms, if we prioritised the plastic packaging issue and preserving the growers margins (i.e. ensuring they are not penalised for their packaging choices with levies) what happens when the choice is to forego the plastic packaging, leave the cucumbers unwrapped, and push the onus of responsible consumption and disposal with the consumer?

Cucumber Production and Consumption in Australia

Annual Production: As of June 2019, Australia produced approximately 93,768 tonnes of cucumbers.

Household Purchase Rate: Over 68% of Australian households purchase cucumbers during their shopping trips.

Per Capita Supply: The supply per capita stands at 3.5 kg, based on the volume supplied.

With this rough data at hand, let’s do some topline modelling. Assuming 20% of the total production was wasted before it could be consumed due to crop loss, freight damage etc. This leaves us with 75,000 tonnes, and we could assume that 68% of this is purchased by a consumer. 51,000 tonnes. To quantify this into numbers of cucumbers, using a mid range weight of 350g per cucumber, that equates to 145,700,000 cucumbers.

Average Shelf Life of Cucumbers

Unwrapped Cucumbers

At room temperature, unwrapped cucumbers can start to deteriorate within 3 days, showing signs of softness and spoilage.

When stored in the refrigerator, unwrapped cucumbers typically last between 4 to 7 days.

Wrapped Cucumbers

When stored in the refrigerator, wrapped cucumbers can last up to 14 days.

Considering the process of harvest and packaging, then transport to the retailer:

Distribution Timeline: For large scale producers, cucumbers are usually harvested daily. Post harvest they undergo a cooling process that lasts 1-2 days. It then takes 2-5 days to get to retail shelves. It takes about 5-7 days from harvest for cucumbers to reach retail shelves.

When weighing up all the factors, and making some broad assumptions:

Shelf Life Without Packaging: If unwrapped cucumbers begin to degrade within 3 days at room temperature, you can assume all of these cucumbers are waste. Thank goodness for refrigeration!

Shelf Life Without Packaging but Refrigerated: If refrigerated unwrapped cucumbers last between 4-7 days, but it takes them 5-7 days from harvest to shelves… it’s not looking good is it…. 🙁 but let’s assume on the positive side they do make it to the retailer looking fresh and not beginning to spoil.

Consumer Purchase and Usage: If a consumer purchases an unwrapped cucumber 1-2 days after it arrives on the shelf, they would need to consume it within 1 day to avoid spoilage.

What is the likelihood is of that happening? It’s not likely. Why? Cucumbers are considered a ‘flavour enhancer’ – which is a vegetable that elevates the flavour of dishes and are often seen as staples in the fridge. Meaning people are expecting to use a cucumber across more than one meal, or for it to be able to maintain its freshness until first use, which may be multiple days past purchase.

Even if 20% of the cucumbers were eaten within their ‘acceptable consumption period’ that leaves 116,000,000 cucumbers destined for disposal. That is 40,800 tonnes.

Let’s assume that the 23% of Australians who compost their kitchen waste help divert some of that from landfill. (We need more of you! If you’re not on the composting bandwagon – there is no excuse – check out our pals at Compost Revolution).

This leaves 89,320,000 cucumbers (31,000 tonnes) heading for landfill. That adds 1% to Australia’s food waste problem. Doesn’t sound like much? Multiply that by every type of fresh fruit, vegetable or herb that requires plastic packaging to preserve shelf life, and we have a much more significant problem on our hands.

With climate change and extreme weather events being the #1 environmental concern in Australia, let’s consider this in more detail.

Greenhouse gas emissions are the leading cause of climate change and extreme weather events. Methane emissions from landfill are significant contributors to greenhouse gases. Organic waste (such as food waste) produces methane (28 times more potent than CO₂ over a 100-year period). In Australia – landfill contributes to 11% of methane production.

Now we are in a situation where the growers are contributing to one of the major issues that affect their livelihood – significant crop loss due to weather extremes. Forced to contribute to increased long term disruption to their business, to favour a short term impact of simply staying in business.

Not only that, with the reduction in shelf life of cucumbers, this would result in an eventual large scale decline of cucumber purchases overall.

Lucky you aren’t a cucumber grower…..

The Consultation Findings

As of 28th February 2025, the findings have been released. There was a surprising lack of detail provided, given the number of questions required as part of the consultation submission.

Ultimately, the final consultation report showed that the respondents overwhelmingly rejected APCO. Some other insights:

65% of respondents supported a federally managed EPR scheme with strict packaging mandates.

Strong backing for outright bans on problematic plastics, regardless of industry concerns.

Support for national consistency, including mandatory recycled content thresholds and enforced levies for non-compliance.

There was a strong preference for EPR scheme revenue funds to be reinvested into the packaging supply chain.

Respondents supported a financial mechanism which uses eco-modulation to drive more sustainable packaging design.

There was strong support for mandatory on-pack recyclability labelling obligations.

Some respondents (like us) advocated for EPR fees and reform outcomes to account for a broader range of environmental outcomes (e.g. emissions reduction).

Our preference saw us in the minority, making up only 4% who preferred Option 1 – Strengthening administration of the co-regulatory arrangement (just under 1% supported option 1 while option 3 was developed).

From an industry perspective, these findings signaled a radical shift away from voluntary compliance towards government imposed regulations that will disrupt existing business models.

In principle, we support any and all reform options that deliver the right results. We champion a circular economy that drives real environmental impact, but we also advocate for practical, industry designed solutions that enable growers to thrive, innovate, and continue feeding Australia.

Fresh Produce Sector Implications

Industry Disruption

With Option 2 and 3 now looking far more likely than we initially predicted, if the government implements strict packaging bans and levies, fresh produce businesses face serious challenges, including:

Rising costs: Increased expenses for compliant packaging materials.

Limited access to alternatives: Many recyclable or compostable options do not yet exist for certain packaging types.

Supply chain pressure: Retailers may refuse to absorb cost increases, forcing growers to either pay more or switch to inferior packaging options.

Increased food waste: Many packaging solutions play a critical role in extending shelf life and reducing waste.

So what now?

While further consultation is planned, and we know we still have time before any changes will be announced, it’s time to take a look at your packaging and understand if these changes will impact you.

- Inform yourself

- Familiarise yourself with the packaging at risk

- Conduct packaging audits

- Both Internally and with with your packaging supplier

- Engage with retailers to push for sustainable packaging transitions

- Get in touch with your retailer category manager to understand what plans they may be making now.

- Advocate for phased implementation rather than immediate bans

- Get in touch with DCCEEW packagingreform@dcceew.gov.au and your local MP to advocate for what works for your business

- Invest in trials for alternative packaging solutions

- Talk to your packaging provider about alternatives and start planning for any potential changes to limit your risk

- Participate in further government consultations to ensure industry representation

- Register your details on the DCCEEW site and connect with APCO and express your interest in being part of future consultations.

Naturpac on Sustainability

At Naturpac, sustainability isn’t just a goal—it’s the foundation of everything we do. We were founded with a clear purpose: to drive meaningful change in packaging by offering sustainable alternatives that reduce environmental impact while maintaining essential functionality. Our commitment extends beyond simply reducing plastic use; we focus on the entire lifecycle of packaging, ensuring that sustainability measures don’t create unintended consequences that could undermine their environmental benefits.

A Holistic Approach to Sustainable Packaging

Naturpac was established in response to the growing need for practical, scalable solutions that allow fresh produce businesses to transition towards greener packaging without sacrificing product quality, shelf life, or supply chain efficiency. While many sustainability initiatives focus solely on the elimination of plastic, we recognise that the issue is far more complex than simply removing materials from packaging.

Beyond Plastic Reduction

Our mission has always been to provide viable, responsible alternatives that consider the broader environmental, economic, and food security impacts of packaging decisions. While reducing plastic is a critical objective, there are other essential sustainability factors that must be equally prioritised, including:

- Food Waste Prevention: Packaging plays a pivotal role in extending the shelf life of fresh produce, protecting it from premature spoilage, and ensuring food reaches consumers in optimal condition. Inadequate or poorly designed packaging can lead to increased food waste—a major contributor to global carbon emissions.

- Recyclability and Infrastructure Readiness: Sustainable packaging must be functionally recyclable within existing systems. A material may be technically recyclable, but if collection and processing infrastructure aren’t in place, it simply ends up in landfill.

- Carbon Footprint Considerations: Substituting one material for another isn’t always a net positive. Some alternative materials require significantly higher energy inputs or create a greater carbon footprint through their production, transportation, and disposal.

- Grower and Industry Viability: Packaging solutions must be affordable, accessible, and scalable for fresh produce businesses, particularly growers who already operate on tight margins.

Balancing Sustainability with Practicality

As passionate advocates for sustainability, we fully support responsible regulatory changes that drive the industry toward better environmental outcomes. However, we also believe that packaging reform must be evidence-based, balanced, and achievable. It must acknowledge that one-size-fits-all approaches do not work—especially when the fresh produce sector faces unique challenges in packaging design and material suitability.

Naturpac remains committed to engaging in meaningful discussions around packaging reform, advocating for sustainable yet realistic solutions that help businesses transition without disrupting food security, increasing waste, or imposing unnecessary financial burdens. True sustainability means considering all environmental factors, and that’s the approach we will continue to champion.